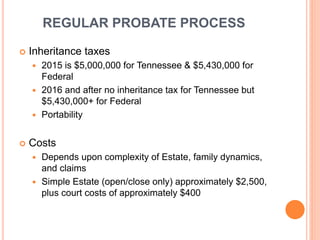

does tennessee have inheritance tax

Which states have no inheritance tax. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or later.

What The Trust Estate Planning And Probate

The Federal estate tax only affects02 of Estates.

. Tennessee does not have an inheritance tax either. Washington doesnt have an inheritance tax or state income tax but it does have an. Even though this is good news its not really that surprising.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. There are NO Tennessee Inheritance Tax. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax exemption threshold of 25000 for children-in-law that wouldnt be considered income and you would be free to enjoy the inheritance without worrying about taxes.

It also reduces your federal estate tax exemption. The Federal estate tax only affects02 of Estates. Spouses are exempt from inheritance taxation while children can be exempt or pay a minimal amount.

Any amount gifted to one person over that limit counts against your lifetime gift tax exemption of 1118 million. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a. It has no inheritance tax nor does it have a gift tax.

For example the neighboring state of Kentucky does have an inheritance tax. For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor administrator or trustee and it. For any estate that is valued under the exemption.

Only seven states impose and inheritance tax. The inheritance tax applies to money and assets after distribution to a persons heirs. However it applies only to the estate physically located and transferred within the state between Tennessee residents.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. All inheritance are exempt in the State of Tennessee. For any estate that is valued under the exemption.

What is the inheritance tax rate in Tennessee. The inheritance tax is levied on an estate when a person passes away. Tennessees tax exemption schedule is as follows.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Recently states have moved away from these taxes or raised the exemption levels. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

Only those estates that are valued 5 million or more are subject to the Tennessee estate tax. What is the state of Tennessee inheritance tax rate. There are NO Tennessee Inheritance Tax.

The Federal estate tax only affects02 of Estates. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Kentucky for instance has an inheritance tax that applies to all property in the state even if the person inheriting it lives elsewhere.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. The inheritance tax is paid out of the. Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that were valued over a certain.

The tax in these states ranges from 0 to 18. As of December 31 2015 the inheritance tax was eliminated in Tennessee. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016.

Indiana Ohio and North Carolina had estate taxes but. There are NO Tennessee Inheritance Tax. What is the state of Tennessee inheritance tax rate.

There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. For example if a Tennessee resident receives in Heritance from someone who died in Pennsylvania they can. No estate tax or inheritance tax.

Tennessee does not have an inheritance tax either. The beneficiary who receives the inheritance has to pay the tax. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

It is possible though for Tennessee residence to be subject to an inheritance tax in another state. Although there is no federal tax on it inheritance is taxable in 6 states within the US. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

Year Amount Exempted. There are NO Tennessee Inheritance Tax. Tennessee is an inheritance tax and estate tax-free state.

What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. All inheritance are exempt in the State of Tennessee.

However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. No estate tax or inheritance tax. It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming. Technically Tennessee residents dont have to pay the inheritance tax. All inheritance are exempt in the State of Tennessee.

States With No Income Tax Or Estate Tax The states with this powerful tax combination of no state estate tax and no income tax are.

State Estate And Inheritance Taxes Itep

How Much Does It Cost To Have A Will Drafted In Tennessee

How To Leave A Life Estate To Your Spouse In Your Tennessee Home Cumberland Legacy Law

Probate Category Archives Tennessee Estate Law Blog Published By Nashville Tennessee Estate Attorneys The Higgins Firm

State Estate And Inheritance Taxes Itep

Probate Lawyers Lebanon Tn Wills Trusts Administration Litigation

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Retirement Tax Friendliness Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Tennessee Retirement Tax Friendliness Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Historical Tennessee Tax Policy Information Ballotpedia

Application For Tennessee Inheritance Tax Waiver State Tn Fill And Sign Printable Template Online Us Legal Forms

11 Estate Taxes And Inheritance Planning Faqs Taxact Blog

How Is Tax Liability Calculated Common Tax Questions Answered